Payment Gateway Outage: How to Prepare and Respond

Payment Gateway Outage: How to Prepare and Respond

A payment gateway outage can bring your entire business to a grinding halt. When customers can't complete purchases, revenue stops flowing, trust erodes, and support tickets pile up. Whether you're running an e-commerce store, SaaS platform, or any business that processes online payments, understanding how to handle these critical incidents is essential.

What Is a Payment Gateway Outage?

A payment gateway outage occurs when the service that processes credit card transactions between your website and payment networks becomes unavailable. This can happen due to server failures, network issues, security incidents, or maintenance problems at your payment processor. Common providers like Stripe, PayPal, Square, and Adyen all experience occasional downtime that can impact thousands of businesses simultaneously.

These outages differ from other technical issues because they directly affect revenue generation. While a broken feature might frustrate users, a payment gateway outage prevents them from giving you money altogether.

The Real Cost of Payment Processing Downtime

The financial impact extends beyond lost sales during the outage period. Consider these cascading effects:

Immediate Revenue Loss: Every minute of downtime translates to missed transactions. For high-volume businesses, this can mean thousands of dollars per hour.

Cart Abandonment: Studies show that 70% of customers who experience payment failures don't return to complete their purchase later.

Customer Support Overload: Support teams get flooded with complaints, increasing operational costs and reducing their ability to handle other issues.

Reputation Damage: Customers share negative experiences on social media and review sites, affecting future sales.

Compliance Penalties: Depending on your industry and SLAs, extended outages might trigger contractual penalties or regulatory fines.

Common Causes of Payment Gateway Failures

Understanding why payment gateways fail helps you prepare better contingency plans:

Infrastructure Problems

Payment processors handle millions of transactions daily. Their complex infrastructure includes multiple data centers, load balancers, and redundant systems. When any component fails, it can trigger a payment gateway outage.

Network Connectivity Issues

Payment processing requires communication between multiple parties: your website, the gateway, card networks, and issuing banks. Network problems at any point can break the chain.

Security Incidents

DDoS attacks targeting payment processors can overwhelm their systems. Additionally, security teams might take systems offline to investigate potential breaches.

API Changes and Integration Errors

Payment gateways regularly update their APIs. If your integration doesn't handle these changes gracefully, it might stop working unexpectedly.

Third-Party Dependencies

Payment processors rely on other services too. When those external dependencies affect SLAs and customer trust, the impact ripples through to your business.

Building a Resilient Payment Infrastructure

Preventing complete payment failure requires strategic planning and technical implementation:

Implement Multiple Payment Gateways

Don't put all your eggs in one basket. Configure your system to work with at least two different payment processors. This redundancy ensures you can switch providers if one experiences an outage.

Set up automatic failover logic that detects when the primary gateway isn't responding and routes transactions to your backup provider. Monitor response times and error rates to trigger switches before customers notice problems.

Create Offline Payment Options

For critical transactions, implement fallback methods:

Manual Processing: Train staff to collect payment details securely for later processing

Invoice Systems: Generate invoices that customers can pay when systems recover

Alternative Payment Methods: Accept bank transfers, cryptocurrency, or other payment types that don't rely on traditional gateways

Monitor Gateway Health Proactively

Don't wait for customers to report payment failures. Set up monitoring that checks:

Gateway API response times

Transaction success rates

Error message patterns

Status page updates from your payment providers

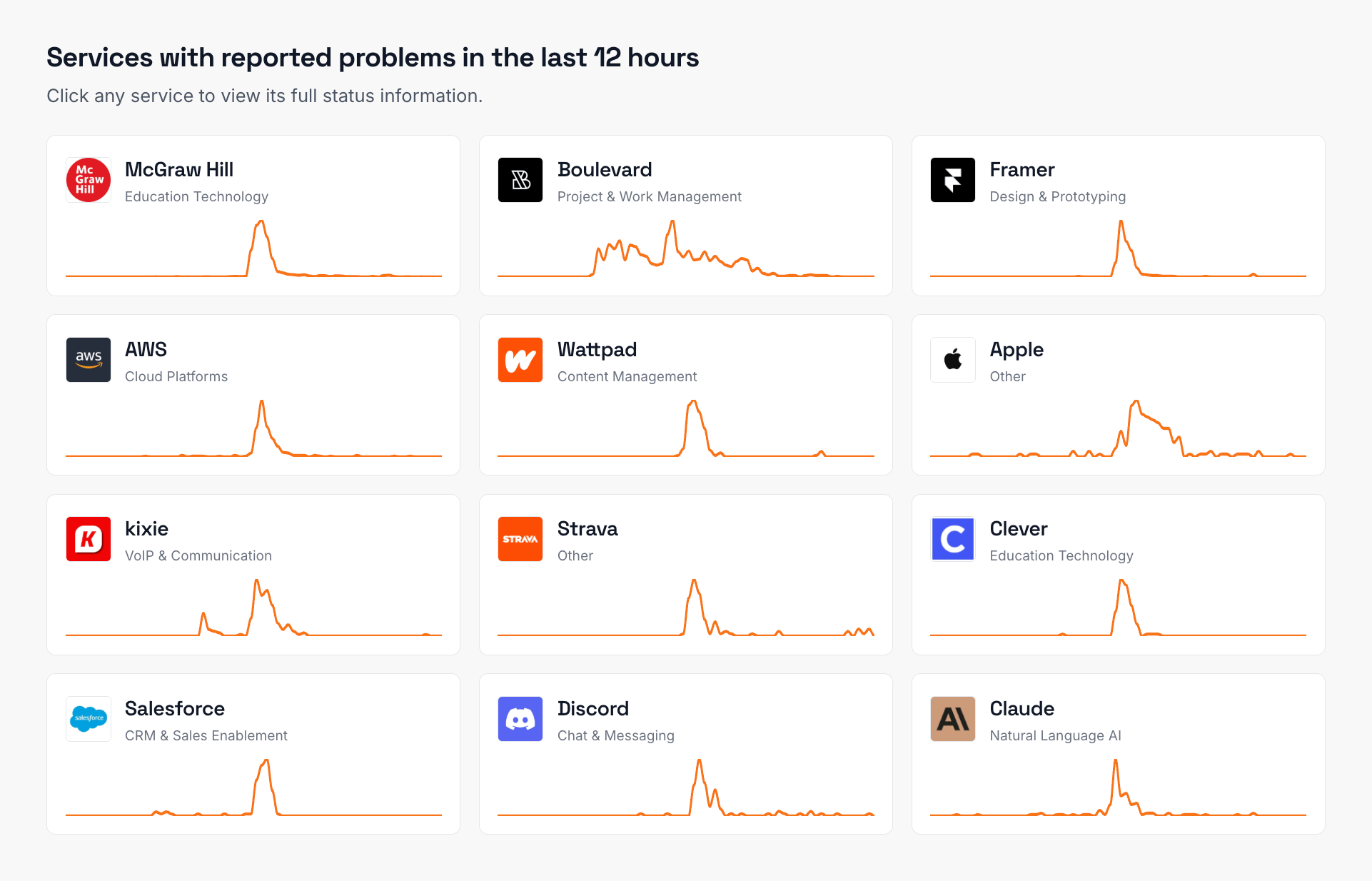

Tools like IsDown can aggregate status information from multiple payment providers into a single dashboard, helping you spot issues early.

helping you spot issues early — whether it’s a payment system slowdown or a broader CDN outage affecting transactions.

Cache Critical Payment Data

Store essential transaction data locally during processing. If the gateway fails mid-transaction, you can retry or complete the payment once service resumes without losing customer information.

Incident Response During a Payment Gateway Outage

When an outage strikes, your response speed and effectiveness determine the impact on your business:

1. Detect and Verify the Issue

Confirm whether the problem is with your integration or the payment gateway itself. Check:

Your payment provider's status page

Error logs from your application

Reports from multiple customers or regions

2. Activate Your Incident Response Team

Notify key stakeholders immediately:

Technical team to investigate and implement workarounds

Customer support to handle inquiries

Management to make business decisions

Marketing to communicate with customers

3. Implement Immediate Workarounds

While investigating the root cause:

Switch to backup payment gateway if available

Enable alternative payment methods

Display clear error messages explaining the situation

Offer customers the option to save their cart for later

4. Communicate Transparently

Keep customers informed through:

Website banners explaining the issue

Email updates to affected customers

Social media posts acknowledging the problem

Status page updates showing real-time information

5. Document Everything

Record all actions taken, decisions made, and communications sent. This documentation helps with post-incident analysis and potential compensation claims.

Recovery and Post-Incident Actions

Once the payment gateway outage ends, your work isn't finished:

Process Pending Transactions

Review all failed transactions and determine which can be retried. Contact customers whose payments failed to complete their purchases.

Analyze the Impact

Calculate:

Total revenue lost

Number of affected transactions

Customer support ticket volume

Any SLA breaches

Conduct a Post-Mortem

Gather your team to review:

How quickly you detected the issue

Effectiveness of your response

Communication clarity

Areas for improvement

Update Your Procedures

Based on lessons learned:

Refine your incident response playbook

Adjust monitoring thresholds

Improve failover mechanisms

Update customer communication templates

Seek Compensation

Review your contract with the payment gateway provider. Many offer service credits or compensation for extended outages that breach SLA agreements.

Best Practices for Payment Gateway Resilience

Test Regularly: Conduct failover drills quarterly to ensure backup systems work as expected.

Monitor Continuously: Track payment success rates and response times 24/7 to catch issues early.

Maintain Relationships: Build connections with multiple payment providers so you can quickly establish new accounts if needed.

Plan for Peak Times: Ensure your payment infrastructure can handle traffic spikes during sales events or seasonal peaks.

Keep Documentation Current: Maintain up-to-date runbooks detailing how to handle payment failures.

Train Your Team: Everyone who might respond to a payment gateway outage should know their role and have access to necessary tools.

Frequently Asked Questions

How long do payment gateway outages typically last?

Most payment gateway outages resolve within 30 minutes to 2 hours. Major providers have robust infrastructure and incident response teams working to minimize downtime. However, severe incidents can occasionally last several hours or even impact service intermittently over multiple days.

Can I get compensation for lost revenue during a payment gateway outage?

Compensation depends on your service agreement with the payment processor. Most providers offer service credits for extended outages that violate their SLA terms. However, they rarely compensate for lost revenue or indirect damages. Review your contract carefully and document all losses for potential claims.

Should I inform customers immediately when experiencing a payment gateway outage?

Yes, transparent communication builds trust. Display a clear message on your checkout page explaining the temporary issue and providing alternatives. Quick acknowledgment prevents customer frustration and reduces support ticket volume. Update your status page and social media channels to keep customers informed about resolution progress.

How many backup payment gateways should my business have?

Most businesses should maintain relationships with 2-3 payment gateway providers. Your primary gateway handles normal operations, a secondary provides automatic failover capability, and a third serves as a manual backup option. The exact number depends on your transaction volume and risk tolerance.

What's the difference between a payment gateway outage and a merchant account issue?

A payment gateway outage affects the service that routes transactions between your website and payment networks, impacting all merchants using that gateway. A merchant account issue is specific to your business relationship with the acquiring bank and only affects your ability to process payments. Gateway outages are typically shorter but affect more businesses.

How can I test my payment gateway failover without disrupting real transactions?

Use sandbox or test environments provided by payment gateways to simulate outages and test your failover logic. Schedule maintenance windows during low-traffic periods to test with real systems. Create specific test scenarios that trigger your failover conditions without affecting production transactions. Document test results and refine your procedures based on findings.

Nuno Tomas

Founder of IsDown

Nuno Tomas

Founder of IsDown

The Status Page Aggregator with Early Outage Detection

Unified vendor dashboard

Early Outage Detection

Stop the Support Flood

Related articles

Never again lose time looking in the wrong place

14-day free trial · No credit card required · No code required